how to file back taxes yourself

In either case the steps for filing back taxes are the same. Track down any missing documents if necessary.

4 Days Left Income Tax Return Income Tax Tax Return

Before you file back taxes make sure you have all the relevant tax forms for that tax year.

. 7 Step 4 If you owe taxes. Lodge your tax return with a registered tax agent. Step 1 Get your wage and income transcripts from the IRS.

First you will want to gather all documents related to filing your taxes such as a W2 if you are employed or a Form 1090-MISC if you are an independent contractor. Organize your information and documents. Gather information from your records to complete the return.

4 Step 1 Get your wage and income transcripts from the IRS. You can also order your businesss account transcript to see any payments or other credits that posted to the IRS account for that tax year. Steps to filing back taxes Gather your information.

Prepare and lodge your own tax return online it is the quick safe and secure way to lodge most process in 2 weeks. To file back taxes youll need to purchase the edition of HR Blocks software for the year or years that you need to file. If you are experiencing difficulty preparing your return you may be eligible for assistance through the Volunteer Income Tax Assistance VITA or the Tax Counseling for the Elderly TCE programs.

Our software is easy to use and will guarantee you receive your maximum refund amount. Collect W-2s 1099 tax forms and any other income or expense statements. If you want to tackle filing your back taxes by yourself choose a reputable tax software company to assist you.

If you file a joint return both spouses must sign the return. Get our online tax forms and instructions to file your past due return or order them by calling 800-TAX-FORM 800-829-3676 or 800-829-4059 for TTYTDD. For example if you did not file 2015 taxes in 2016 you need to download the 2015 tax year forms to file.

For signing a paper tax return. If you file a petition attach an entire copy of the CP3219N to the petition. If your spouse cannot sign because of a medical condition and requests that you sign the return sign your spouses name in the proper place followed by the word by then your signature followed by the word husband or wife.

3 Should you file your tax returns if you cant pay the taxes. Make sure you actually have to pay. Start by requesting transcripts from the IRS.

The forms also give you information about submitting your returns online you would file them at the same address you would have filed your taxes had they been on time. You can do a search using how to file your taxes by yourself and youll get at least 30 million results. So if you dont file youre paying 10 times higher penalties than you do if you do file but dont pay the taxes you owe right away.

This is because the failure-to-file penalty is 5 of your taxes due per month up to 25 of your total tax bill. This is one of the reasons we decided to go with a low flat rate of 25 for any type of personal return. You can also file IRS Form 9465 the Installment Agreement Request with your tax return regardless of how much you owe.

Back taxes require the. If the CP3219N is addressed to a person who is outside of the United States the deadline to file a petition with the Tax Court is extended to 150 days from the date of the CP3219N. Give yourself credit for getting it done and await receipt of your Notices of Assessment.

How to File Back Taxes. The IRS charges a fee for the installment agreement unless you think you can pay your balance off within 180 days six months. You may file by regular mail or use one of the tax help services to file your late taxes.

If you need to file back taxes youll want to follow these four steps. If you want to tackle filing your back taxes by yourself choose a reputable tax software company to assist you. Your assessments should be matched to what was filed and reviewed for penalties and interest inclusions.

6 Step 3 Mail your tax returns. How to File Your Taxes Online. Before you file back taxes make sure you have all the relevant tax forms for that.

5 Step 2 Prepare and file your tax returns. Filing back taxes is something you can do on your own but if you have a more complicated return you may want to enlist the help of a tax professional. Use a registered tax agent to prepare and lodge your tax return they are the only.

The last day to file a petition is stated in your CP3219N. The failure-to-pay penalty is much less05 per month with the same 25 limit. This guide will walk you through exactly how to file back taxes.

If thats not confusing enough youll see so many different pricing tiers it will discourage you. Ad BBB Accredited A Rating. Complete your tax return.

Get Your 2019 Tax Refund ASAP.

You Can File Your Tax Return On Your Own It S Easy Quick And Free When You File With Tax2win On Your Onenote Template Income Tax Preparation Tax Preparation

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Video Video Tax Help Back Taxes Help Tax

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Tax Filing Time Tax Day Cards Birthday Greeting Cards By Davia Filing Taxes Tax Day Birthday Greeting Cards

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Irs Penalty Calculator Infographic Tax Relief Center Irs Irs Taxes Making A Budget

5 Important Questions To Ask Before You Decide To Do Your Own Taxes Grand Ascent Tax Tax Help Tax Write Offs

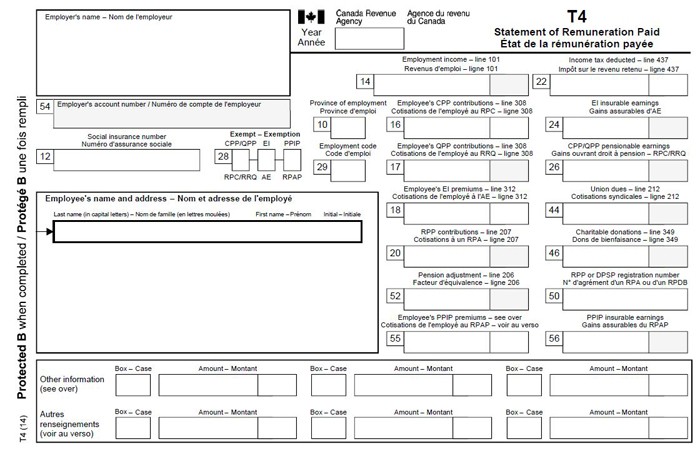

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

If Till Now Not Filed Your Income Tax Return Before 31 Dec 2018 Calculate Your Late Filing Fee Latefee Sec234f Inc Income Tax Return Income Tax Tax Return

Don T Be Late It S The Tax Day On Or Before 31st July Infographic Rgscandcompany Tax Day Finances Money Tax

A Step By Step Guide To Filing Back Taxes Tax Relief Center Business Tax Tax Help Managing Finances

Tax Forms To Expect From These 3 Common Sources Blog Personalfinance Taxes Efile Online Taxes Tax Forms File Taxes Online

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Two Days Left To File Your Itr Income Tax Return Income Tax Filing Taxes

Tax Tip Shield Yourself From Tax Scams And Fraud As Tax Season Approaches Many People Start Getting Phone Calls Ema Tax Money Tax Return Tax Deductions